What Is a Silver Certificate and Why Collectors Care

Silver certificates represent a unique chapter in United States monetary history. First issued in 1878, these notes promised the bearer that they could be redeemed for an equivalent amount of silver dollars or bullion. While they ceased to be redeemable for silver in 1968, their legacy endures among collectors and historians. Many wonder are silver certificates worth anything beyond face value. Today, these certificates draw interest for their historical context, artistic engraving, and varied print runs.

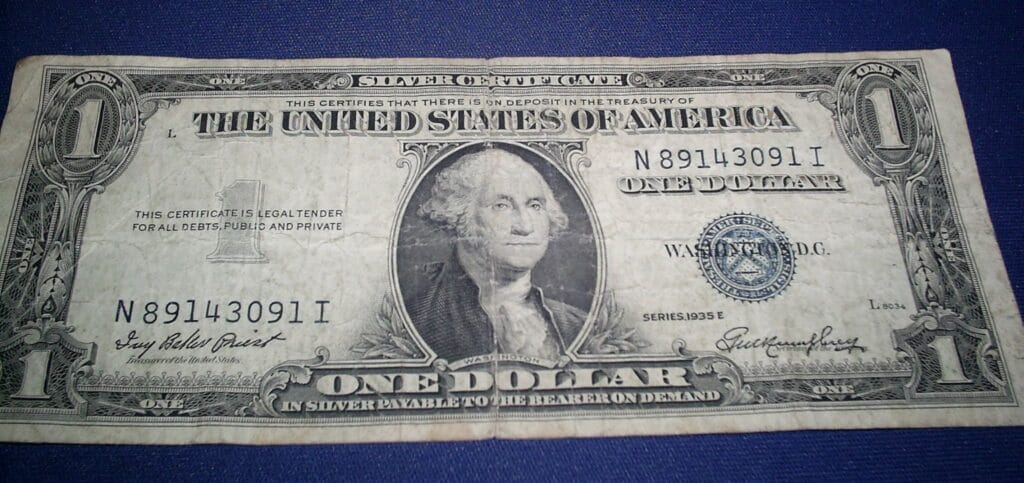

Original certificates feature elaborate vignettes, portraits of national figures, and intricate Treasury seals. Over the decades, designs evolved from scenes of mining and exploration to the more streamlined Series 1935 and 1957 notes. Collectors prize early issues for rarity and aesthetic appeal. Later issues attract those who appreciate the connection to midcentury American life. The wide span of series ensures a diverse market, appealing both to novice enthusiasts and specialized paper money investors.

Silver Certificates Versus Physical Silver Investments

Silver certificates occupy a distinct niche when compared to physical silver investments. Physical silver—whether in the form of bullion bars, coins, or rounds—carries intrinsic metal value linked directly to spot prices on global markets. Investors frequently purchase American Silver Eagles or silver bars from reputable dealers to gain exposure to changing industrial and monetary demand. Organizations such as the United States Mint provide transparent mintage and authentication, creating a direct link between silver holdings and market performance (U.S. Mint, 2025).

By contrast, silver certificates have no intrinsic silver content. Their value derives entirely from collectibility, condition, and rarity. A one-ounce silver bar tracks the metal price precisely, minus dealer premiums. A circulated 1957 one-dollar certificate might sell for only two to five dollars above its face value. However, a pristine example or a rare variant can command a premium far above typical bullion prices. Collectors view certificates as historical artifacts rather than direct investments in metal. Understanding this distinction sets realistic expectations when choosing between paper money and physical silver.

Factors That Drive Certificate Value

Several objective factors influence how much a silver certificate will sell for in today’s market:

- Condition

Notes graded as uncirculated or about uncirculated (AU) fetch the highest prices. Tearing, folds, and staining reduce value significantly. Professional grading by companies such as PCGS Currency provides reliable condition assessments (PCGS Currency, 2024). - Rarity

Early series with smaller print runs or withdrawn varieties, such as the 1891 Educational Series, remain scarce. Limited supply coupled with collector demand drives prices upward. - Serial Numbers

Low-numbered notes (for example, serials below 00000010) and repeating or radar serials draw enthusiast interest. Collectors pay premiums for memorable serial sequences. - Star Notes

Star prefix notes indicate replacements for flawed prints. These automatically scarce variants trade at higher rates. Star notes from the Series 1935 often sell for two to three times the price of common counterparts. - silver one dollar bill value

While most one-dollar certificates trade near face value, certain series and conditions can elevate a note’s worth. For example, an uncirculated Series 1899 one-dollar certificate may reach three hundred dollars at auction, reflecting both historical significance and collectible appeal (NGC, 2025).

By focusing on these quantifiable criteria, collectors and sellers can gauge market interest and set appropriate price expectations.

Face Value Versus Collector Premium Explained

Every silver certificate retains its one-dollar face value in general transactions. However, once a note enters the collector market, it seldom returns to general circulation. Instead, it commands a collector premium—the amount above face value that reflects desirability. The size of this premium varies:

• Common circulated notes from the Series 1957 in good condition sell for two to five dollars.

• Uncirculated Series 1935 notes often trade for ten to twenty dollars.

• Rare or well-preserved early issues can sell for hundreds or even thousands of dollars.

Price guides such as the Professional Coin Grading Service’s “Currency Price Guide” offer median values for specific grades and series. Online auction results on major platforms also provide real-time sales data. By comparing published guide values with recent auction results, sellers can estimate fair market premiums accurately.

Checklist for Evaluating Your Own Certificates

Before selling or trading your silver certificates, use this checklist to assess each note’s market potential:

- Identify the series year and issuance date.

- Look for Federal Reserve seals and district letters.

- Inspect paper quality: check for tears, folds, stains, and repairs.

- Confirm the presence of star prefixes for replacement notes.

- Compare note appearance to high-resolution images in authoritative price guides.

- Consider professional grading if a note appears to be uncirculated or rare.

- Document each note with photographs showing both sides and any unique features.

A systematic evaluation positions you to negotiate effectively. It helps ensure you receive a price that reflects your note’s true collectible value rather than simple face-value redemption.

By understanding what silver certificates represent, how they differ from physical silver, and which factors most influence their market price, you establish a clear foundation for appraising and selling these historic notes. For a precise valuation, you may wish to consult a reputable Chicago pawn shop. Their experts can offer an informed appraisal and guide you through the selling process.

Current Market Values From Common Notes to Rare Issues

Silver certificates span a broad value spectrum, from pocket change to serious investment pieces. Common Series 1957 one-dollar notes in circulated condition usually trade for three to six dollars at major auction venues such as Heritage Auctions (Heritage Auctions 2024). If you compare multiple auction archives, you will find that uncirculated examples from the same series often reach fifteen or twenty dollars.

On the rare side, Series 1891 Educational Certificates can command four-figure prices. Recent PCGS Currency sales show Choice Uncirculated examples fetching between twelve hundred and fifteen hundred dollars (PCGS Currency 2025). Star prefix replacements from the 1935 series routinely sell for ten to fifteen percent more than their plain counterparts. Collectors curious about how much is a silver dollar certificate worth should reference both live auction data and published price guides to gauge fair market value.

Reading Grading Scales and Condition Categories

Understanding grading scales is crucial before selling. The industry standard runs from Poor (grade 1) to Superb Gem Uncirculated (grade 70). Rather than recite every grade, focus on these three broad tiers:

• Lower grades (1–20) exhibit heavy wear and sell near face value.

• Mid grades (30–50) display moderate circulation marks and can trade for two to five times face.

• High grades (55–70) include uncirculated notes; these often command significant premiums.

When evaluating condition, look for original paper sheen, sharp corners, and clear ink. A single fold or stain can drop a note from Extremely Fine to Very Fine, cutting its value by up to fifty percent. Professional grading by services such as NGC Paper Money provides a reliable third-party assessment, ensuring buyers pay top dollar for authenticated, high-grade certificates.

Where and How to Appraise or Sell

You have several channels for appraisal and sale:

- Coin and Currency Dealers

Appointments ensure specialized attention. Dealers often maintain up-to-date price lists and can offer immediate cash for high-value notes. - Online Auction Platforms

Sites such as eBay and GreatCollections reach a national audience. Be mindful of listing fees and shipping risks. - Pawn Shops and Estate Buyers

These venues favor quick transactions. While offers may fall below auction levels, you avoid seller fees and long wait times.

Keep in mind the value of a silver dollar bill can vary by as much as thirty percent across venues. Before committing, compare at least two dealer quotes and review recent auction completions. Document your notes with high-resolution photos to ensure transparency and track sales trends.

Negotiation Pointers and Pitfalls to Avoid

Effective negotiation begins with preparation. Know the certified grade or your own grade estimate and reference recent sales of identical series and condition. Request a breakdown of any offered rate to understand dealer margins and fees. Avoid accepting the first offer without comparison unless you lack time or require immediate funds.

Be wary of buyers who apply vague condition terms or refuse to show comparable sales data. Legitimate dealers and auction houses will provide clear rationale for their bids. Do not assume that a single buyer’s quote reflects the entire market. Seeking multiple opinions often reveals a narrower fair value range and strengthens your negotiating position. Maintain a professional demeanor and be prepared to walk away if terms do not meet your informed expectations.

Legal Tender Status and Redemption Myths Debunked

Silver certificates remain legal tender at face value but are no longer redeemable in silver bullion. The Treasury ended redemption in 1968, and attempts to exchange today will be refused. Here is what you need to know:

• Legal Tender – Valid for one-dollar payments in commerce, though rarely used this way.

• Redemption Claims – No certificate can now be exchanged for silver coins or bullion.

• Collector Value Only – All market worth comes from numismatic interest, not metal content.

Common myths suggest older notes retain a silver clause; this has no legal basis. The Federal Reserve and U.S. Treasury both confirm that paper certificates carry only their face value as currency. Sellers should focus solely on collector markets when determining worth.

Feel free to visit a reputable Chicago pawn shop for an in-depth appraisal of your certificates. Experienced staff can provide immediate, fact-based valuations that reflect today’s market.

Spotlight on Rare Designs and Error Notes

Among silver certificates, certain designs and printing anomalies command exceptional interest and premium prices. One standout is the 1899 Black Eagle Educational Series one‐dollar certificate. These notes feature allegorical representations of industry and agriculture flanking a bald eagle; in uncirculated grades they frequently sell for twelve hundred to eighteen hundred dollars (PCGS Currency Price Guide, 2025). Their intricate artwork and limited print run of fewer than forty thousand pieces drive collector demand.

Error notes also attract specialized buyers. Star‐prefix replacements from the 1935 Series one‐dollar certificates—used to substitute damaged originals at the Bureau of Engraving and Printing—trade at premiums of twenty to fifty percent over standard issues (NGC Coin, 2024). Misalignment errors such as off‐center seals or double‐denomination prints can further elevate silver dollar bill value, with some error specimens achieving two to three times the price of perfectly printed counterparts.

Other notable rarities include the 1896 Educational Certificate Series, which saw fewer than twenty thousand notes issued. These examples in high grade often cross the auction block above two thousand dollars (Heritage Auctions, 2024). Awareness of these rare designs and errors allows collectors to identify hidden gems in mixed collections and prioritize professional grading for potential high‐value items.

Building a Diversified Paper Money Collection

Creating a resilient collection means balancing depth and breadth. Start by assembling one example of each major silver certificate series: 1878, 1891, 1896, 1899, 1935, and 1957. This approach provides historical context and covers key design evolutions. Next, pursue one high‐grade star note and one misprint note in any series to represent error varieties.

Diversification strategies include focusing on:

• Series variety: Holding at least one note from each issuance year preserves a complete lineage

• Grade spectrum: Acquiring circulated, about uncirculated, and uncirculated examples demonstrates condition diversity

• Denomination mix: While one‐dollar certificates dominate, two‐dollar notes from the 1896 and 1899 Educational Series add rarity

• Plate position: Low‐numbered serials and block print variants enhance collecting depth

By systematically targeting these categories, collectors build both a comprehensive historical narrative and a portfolio capable of weathering market shifts. Reference print run figures in the Standard Catalog of United States Paper Money for precise rarity estimates (Flynn and Schechter 2023).

Protecting and Storing High Value Currency

Preservation is paramount for maintaining certificate condition and value. Follow these best practices:

- Use inert holders: Archival‐safe currency sleeves or Mylar flips prevent acid migration and paper discoloration

- Control environment: Store notes at stable temperature and humidity—ideally 65°F with 40 percent relative humidity—to reduce mold and ink fading

- Limit handling: Wear cotton gloves or handle edges only; natural oils from skin can degrade paper fibers

- Avoid light exposure: Ultraviolet light accelerates ink fading; store notes in dark containers or safes equipped with UV‐filtering glass

- Secure storage: Keep high‐value certificates in a fireproof safe or bank deposit box to mitigate theft and fire risk

Professional conservation services can repair minor tears and flatten creases according to archival standards. However, avoid amateur repairs that may disqualify grading services.

Five Step Action Plan for Selling or Holding

- Inventory and Research

Document each certificate’s series, serial number, and condition. Consult authoritative price guides for current value ranges. - Grade or Authenticate

Submit high‐potential notes—rare designs, star issues, or error prints—to a reputable grading service for certification. - Compare Venues

Request quotes from at least two coin dealers, two auction houses, and a trusted pawn shop to identify the most competitive net return. - Prepare for Sale or Storage

Clean, sleeve, and store notes as recommended. If selling, bring graded certificates and printed price references. - Decide and Act

Choose immediate sale for urgent liquidity or hold for potential future appreciation based on market trends and your personal goals.

Consult a trusted Chicago pawn shop for accurate, up‐to‐date assessments of your silver certificates.

Unlock Your Silver Certificate’s True Value Today

Whether you’re a seasoned collector or have recently discovered a stack of silver certificates in the attic, understanding their true worth is the first step toward making an informed decision. From the intricate artistry of rare Educational Series designs to the premiums paid for star‐prefix replacements and printing errors, these notes offer far more than their one‐dollar face value. With clear grading scales, reliable market data, and best practices for preservation, you can confidently evaluate, sell, or hold your paper money.

If you’re ready to turn knowledge into action, remember that the right partner makes all the difference. Clark Pawners has guided thousands of Chicago residents through accurate, transparent currency appraisals—helping them unlock hidden value and navigate every aspect of the buying and selling process. Our experts combine decades of numismatic experience with a customer‐focused approach. Whether you’re seeking a quick quotation or a long‐term sale strategy, we provide up‐to‐the‐minute market insights and personalized service.

Don’t let your silver certificates sit unseen. Visit our homepage to learn more about our appraisal services, explore detailed guides, and schedule a private consultation with one of our specialists: https://clarkpawners.com/. Your certificates’ next chapter starts with a simple click—and the peace of mind that comes from working with Chicago’s trusted experts.